Achieving success in stock trading is impossible without some kind of a trading system or strategy. Money management and risk management play a role, of course, but without a trading system, you really wouldn’t have anything to do.

So what, exactly, is a trading system? In essence, a trading system is a set of rules that tell you when and how to trade. Today, you can easily find many different black box trading systems. Browse through any trading forum or a reputable trading magazine and you’ll find a section dedicated to trading systems and strategies.

Trading systems range from very simple to extremely complex. They can be based on technical indicators or on a complex analysis of fundamentals. Finding a trading system that works best for you requires some experimentation and experience, but it is absolutely necessary if you want to make profitable trades consistently.

Every trading system can be classified into one of two types. It can be either mechanical or discretionary. We can’t tell you which type is better because they both have distinct advantages.

Mechanical Trading Systems

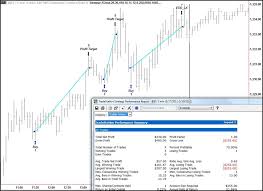

A mechanical trading system is basically a set of trading rules based on a number of technical and/or fundamental indicators. The chosen indicators trigger buying or selling action when trading conditions are met. These systems are very easy to automate and there is no discretion involved.

Instead of manually monitoring the markets, a trader can simply code the rules into an algorithm. Most automated trading systems are mechanical, although discretionary systems can also be based on complex algorithms.

The simplest mechanical systems use technical indicators, but you can also develop a mechanical system based on fundamentals. For example, you could analyze the past behavior of a stock as well as general expectations and program a mechanical trading system based on the earnings release of this stock. Macroeconomic factors can also be used to develop a mechanical trading system.

These are the main advantages of mechanical trading systems:

- Mechanical systems are easy to code or program

- You can easily check the past performance of the trading system

- Mechanical systems are purely based on logic and leave no room for emotions

- There is no need for human interference

However, a mechanical trading system is not always a good choice. For example, in uncertain markets, a mechanical system might not function properly. Furthermore, problems may arise if there are coding errors in a mechanical system.

Discretionary Trading systems

Discretionary systems are a bit more complex than mechanical trading systems. In these systems, the decisions are made based on a combination of trading rules and experience. Because experience is involved, the rules can change at every instance in this type of system. This means discretionary systems are more difficult to. Furthermore, these systems require the assistance of a human so the trader needs to be very familiar with the system in order to make profitable trades.

Using a discretionary trading system is ideal if at least one of these statements is true:

- You plan to manually analyze chars

- A large number of fundamental indicators play a role in shaping the outcome

- You are very familiar with the system you are using

However, beginners often shy away from discretionary trading systems for these reasons:

- Discretionary systems are difficult to code and require human assistance

- Creating a successful discretionary system requires years of practice

- There are no clear rules

The Auto-trading System

Auto-trading systems have become quite popular in day trading. There is a simple reason for this – using an automated system is the easiest way to separate your decisions from your emotions. The signal will be executed regardless of you are feeling and this can be very useful in many situations.

Using an automated trading system is a bit risky, but these systems can also have built-in mechanisms that minimize losses. Many trading platforms offer traders the option of automating their strategies using various programming languages.

When using an auto-trading system, the orders can be sent directly to the market when the conditions are met. However, in most cases, you can also choose to authorize your trades manually before execution. Order authorization does bring a degree of subjectivity into the system, but it also defeats the whole point of using an automated system.

Final Remarks

No matter which type of trading system you are using, it’s always important to have a good understanding of the system and all of the rules it uses. If you want to keep improving your strategy, it’s always a good idea to thoroughly review the system you are using.

You can do this yourself, but there are also various solutions available that can analyze a trading system for you. This can save you a lot of time compared to manually analyzing a system, but the choice is ultimately up to you. In any case, always think about the risk exposure and the maximum drawdown of your chosen system instead of just focusing on the gains.